On 1 July 2025, the Fire Services Property Levy (FSPL) was replaced by the Emergency Services and Volunteers Fund (ESVF). Read more below, visit the State Revenue Office Victoria website or call the ESVF support line on 1300 819 033.

Your rates notice

Rates notices are issued at the beginning of August each year.

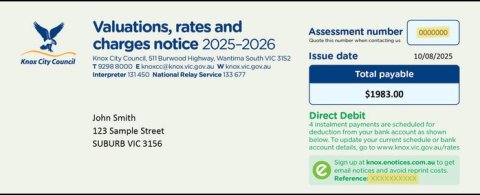

There are two reference numbers on your rates notice that you need for online services:

- Your 7-digit rates Assessment number

- Your eNotices reference number

Pay online with your credit card

- You'll need your 7-digit rates assessment number which is shown at the top of your rates notice.

- Please note all payments made by credit card (MasterCard or Visa only) will incur a 0.4% charge.

Visit our Pay your rates page for other ways to pay.

View your rates online

You can view your current rates notice online if you are registered to receive eNotices.

To register to view future rates notices online, log into eNotices. You will need your eNotices reference number which you can find on your rates notice.

Receive your rates by email

To receive your rates notice via email you can register with our online portal.

Sign up for rates notice emails

Once you have registered you will no longer receive a paper rates notice.

To set up your email notifications, you just need to:

- enter your email address and eNotices reference number found on your rate notice

- check your email inbox and click the validation link

- choose a password and enter your mobile number.

You will be able to access all rates notices that have been issued to you previously and receive email notifications to your inbox for newly issued rates notices.

Reprint rates notice

Your rates notice is a valuable document to keep for taxes, loans, solar rebates and eNotices registration purposes. Reprints may incur a fee.

You can request a copy of rates notices online: you can request a reprint.

- You'll need your 7-digit rates assessment number

- We aim to respond to requests for copies of rates notices within 5 business days.

You can avoid paying a fee by signing up to receive your rates notices online.

Emergency Services and Volunteers Fund

On 1 July 2025, the Fire Services Property Levy (FSPL) was replaced by the Emergency Services and Volunteers Fund (ESVF).

The ESVF is set by the state government to fund the state's emergency services. Although the ESVF appears on rates notices, it is not a council charge for council services.

For more information on how your ESVF charge is calculated, visit the State Revenue Office Victoria website.

Eligible pensioner concession card holder will receive a concession on the ESVF. Visit the pensioner rate concession rebate page for more information.

For more information, you can call the ESFV support line on 1300 819 033.

Rates capping

The state government introduced rate capping in 2015 so that Councils limit annual increases in rates revenue compared to the previous year. The rate cap:

- Is set each year by the Minister for Local Government. For the 2025-26 financial year the rate cap was set at 3%.

- Applies to the percentage increase in a council’s average general rate and municipal charge. It does not apply to your individual bill but rather to the total amount of money that we are seeking from rates revenue.

- Applies to general rates and municipal charges, it does not apply to waste collection charges or the Emergency Services and Volunteers Fund.

Waste collection charge

On your annual rates notice, you'll find your waste collection charge as a separate item to your rates.

The charge varies depending on what waste services you use.

The most common service charge for waste collection is the Residential Garbage Charge for the collection and disposal of garbage and food and garden waste as well as the collection of recyclable materials. The 2025-26 annual Residential Garbage Charge is $415.15. This is the standard charge applicable to all residential properties in Knox.

The complete list of 2025-26 waste collection charges is outlined below.

Knox City Council's budget

Each financial year Council prepares an annual budget based on the priorities of our Council and Health and Wellbeing Plan.

The 2025-26 Annual Budget details how rates will be spent to maintain and deliver the services and facilities our community values and relies on.

Once we have worked out our total spend, then we look at income sources. This includes rates.

Rates represent approximately 70 per cent of Knox City Council's total income.

How your rates are used

Rates and charges revenue funds hundreds of local services and programs that our community uses every day, such as:

- Local roads and bridges

- Sporting pavilions

- Footpaths and bike paths

- Maintaining Council buildings

- Sports fields and training

- Drainage

- Parks and reserves

- Car parks

- Playgrounds.